Hi Friends, In this informative article I will give you complete details on the NBP Loan Scheme for Government Employee| How To Apply. If you are working in the govt sector or private department and you require some loan for your expenditure then it is a piece of good news that the National Bank announced the Advance salary loan program. Govt servants including Pakistan army employees and contractual employees are eligible to apply online as well on the application form available at NBP’s official website www.nbp.com.pk.

Both Federal and provisional government employees may apply if they meet the complete eligibility criteria that they set to grant loans. Individuals with other sources of income may also apply for this loan scheme but must fulfill the requirements of the National Bank Of Pakistan. This article includes,

- Eligibility Criteria for Government and Contractual Employees.

- Eligibility Criteria for Other sources of income

- NBP Loan for Government Employee Interest Rate or Mark up rate.

- How To Apply Online for National Bank Loan Scheme for Govt Servant.

NBP Loan Scheme for Government Employee| How To Apply

Eligibility Criteria for Government Employees

- National Bank Of Pakistan NBP is giving loans in the form of advance salary to government employees.

- Candidates who are permanent and working in Federal, provisional, semi-government, and autonomous departments and receiving salaries from the National Bank are eligible to apply for this NBP loan program.

- The maximum loan limit is Rs.300000/– ( 3 Million)

- After receiving the NBP loan, employees are to return this loan within 4 years(48 Months) with the lowest interest rate or markup rate at only 26.5% fixed per annum.

- The maximum age of applicants at the time of loan should not exceed 59 years and 6 months.

Eligibility Criteria for Contractual Employees

- National Bank account holders’ contractual employees of federal, provisional, semi-government, and autonomous are eligible to apply for an advance salary scheme.

- Contractual employees will get Rs. 2000000/-(2 Million) in the form of a loan from NBP.

- The tenure to return this money is 4 years (48 Months).

- The maximum age limit at the time of the loan is 55 years.

- The lowest interest rate or markup rate will be only 28% fixed per annum.

Eligibility Criteria for Applicants with Other sources of income

| Types of Other Sources of Income | Criteria /Documents Required for Clubbing of Other Income |

| Verified Rental Income | Copy of proof of ownership e.g. Title documents. |

| Verified Agriculture Income | Copy of proof of ownership eg Title documents. |

| Verified Income from Investments (TDRs/National Saving Certificate/ Premium Prize Bond) | Copy of proof of savings e.g TDR/National Saving Certificate/Premium Prize Bond (Registered) Bank Account statement where savings income is being credited at least for the last 6 months. Copy of Income tax return showing the investments in TDR/NSC/PPB |

What Documents are Required for NBP Advance Salary Loan Scheme

To apply for the NBP Loan Scheme for Government employees following documents are to be attached to the application form,

- Last 3 Months Salary Slips/Certificate.

- Employer undertaking.

- Copies of CNICs of Applicant & TWO References (duly attested by concerned NBP branch/Gazetted Officer.

- Copies of Employee ID cards of Applicant & References (attested by NBP branch/Gazetted Officer) where applicable.

- Customer Undertaking on Rs.20/- stamp paper(Bond Paper).

Read, BOP Tractor Loan Scheme 2024

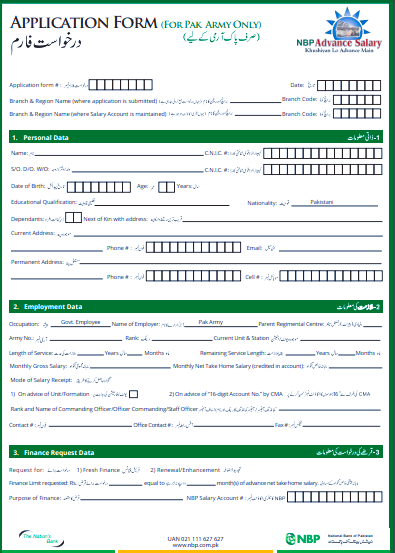

NBP Advance Salary for Pak Army Employees

Pakistan army officers and soldiers are also eligible to apply for the NBP Loan Scheme. While applying for this loan the following documents are required with the application form,

Documents

- Last 3 months Salary Slips/Certificate (signed & stamped by CO/OC/SO).

- Confirmation Certificate (Part-II).

- Copies of CNICs of the applicant, Next of Kin, and two references (attested by CO/OC/SO).

- Copies of Service Certificates of Applicant and references.

- Customer Undertaking (Rs. 20/- stamp paper/bond paper).

How To Apply for NBP Loan Scheme for Government Employee?

Applications are to download the application form in PDF format from the following link and attach the documents mentioned above.

submit the filled application form to the National Bank of Pakistan branch where you are getting your salary.

Application Form for Pak Army Employees

A separate application form is available at the NBP official website for Pakistan Army Employees.

Download the application form from the following link in PDF format.

Fill out the application form properly, attach attested copies of documents, and submit it to the National Bank Branch.

Charges for NBP Advance Salary for Government Employees?

Processing Fee Charges

For Fresh Customers: Rs.2,000/- or 2% of the loan amount whichever is higher,

subject to a maximum ceiling of Rs.20,000/– (plus FED)

For Rollover Customers: Rs.2,000/- or 2% of net fresh/enhanced amount

whichever is higher, subject to a maximum ceiling of Rs.20,000/- (plus FED).

Verification Charges: Actual to verification Agency.

Early Payment Charges: 2% of adjustment amount + FED.

Documentation & Legal Charges: At Actual

Read: HBL Ready Cash Loan 2024

NBP Loan for Government Employee Calculator

NBP Loan for Government and Contractual Employee Calculator will be checked from the below link,

To Check: Click Here

FAQs

What is the limit of NBP advance salary?

The loan limit for government employees is 3 million and for contractual employees is 2 million.

What documents are required for NBP advance salary loan?

Last 3 Months Salary Slips/Certificate.

Employer undertaking.

Copies of CNICs of Applicant & TWO References (duly attested by concerned NBP branch/Gazetted Officer.

Copies of Employee ID cards of Applicant & References (attested by NBP branch/Gazetted Officer) where applicable.

Customer Undertaking on Rs.20/- stamp paper(Bond Paper).